Stable Performance of Listed Auto Companies in Q3, Dealers Under Pressure

As the disclosure of the third quarter reports for A-share companies comes to an end, the latest performance of the auto sector, including vehicle manufacturers and dealers listed on the stock market, has been fully revealed.

iFinD data from Tonghuashun shows that in the first three quarters of this year, the overall performance of the 21 listed vehicle manufacturers on the A-share market was relatively stable. Among them, 12 achieved year-on-year growth in net profit, accounting for about 57%.

Specifically, BYD, Great Wall Motor, and SAIC Group topped the net profit list, achieving net profits of 25.238 billion yuan, 10.428 billion yuan, and 6.907 billion yuan respectively in the first three quarters. In terms of the growth rate of net profit, JAC Motors led with a 240% increase, followed by Zhongtong Bus and Yutong Bus with increases of 165% and 131%, respectively.

In stark contrast, the profitability of listed dealers is worrying. Although some companies have taken drastic measures to slow down the decline in net profit, the overall profit still shows a downward trend. Among the six dealers listed on the A-share market, none of their operating incomes exceeded the level of the same period last year.

Zhang Xiuyang, Secretary-General of the China Passenger Car Industry Alliance, said that under the strategy of maintaining volume by lowering prices, manufacturers make money when selling cars, while dealers lose money. This situation reflects the unequal distribution of interests between the upstream and downstream of the automotive industry chain, between production and sales.

The data shows that the 21 listed vehicle manufacturers achieved a total operating income of 1.6 trillion yuan in the first three quarters of 2024, a year-on-year decrease of 3.2%; the total net profit was 52 billion yuan, a year-on-year decrease of 1.3%.

Specifically, BYD achieved an operating income of 502.251 billion yuan in the first three quarters, a year-on-year increase of 18.94%, and a net profit attributable to the shareholders of the listed company of 25.238 billion yuan, a year-on-year increase of 18.12%. The company's cumulative sales volume in the first three quarters reached 2.7478 million units, of which the single-month sales volume in September increased by 45.6% year-on-year to 419,400 units, setting a new record for the company's single-month sales volume.

SAIC Group achieved an operating income of 419.646 billion yuan in the first three quarters, a year-on-year decrease of 17.39%, and a net profit attributable to the shareholders of the listed company of 6.907 billion yuan, a year-on-year decrease of 39.45%. The company attributed the decline in performance to the decline in the fuel car market and the unprecedentedly fierce price war, which led to a decrease in the company's sales revenue and a decline in gross profit.

Changan Automobile's financial report shows that the company achieved an operating income of 110.96 billion yuan in the first three quarters, a year-on-year increase of 2.54%, and a net profit attributable to the shareholders of the listed company of 3.58 billion yuan, a year-on-year decrease of 63.78%. In the third quarter, the company achieved an operating income of 34.237 billion yuan, a year-on-year decrease of 19.85%, and a net profit attributable to the shareholders of the listed company of 748 million yuan, a year-on-year decrease of 66.44%. At the third quarter performance briefing held on October 29, the company did not directly respond to the third quarter report performance issues, but mentioned more about R&D investment and stock price trends.

It is worth mentioning that Seres' performance in the first three quarters of 2024 was commendable. Benefiting from the continuous growth in sales of high-value products, the company achieved a revenue of 106.627 billion yuan in the first three quarters, a year-on-year increase of 539.24%, and a net profit attributable to the shareholders of the listed company of 4.038 billion yuan, turning a loss into a profit, and a net profit attributable to the shareholders of the listed company excluding non-recurring gains and losses of 3.763 billion yuan.

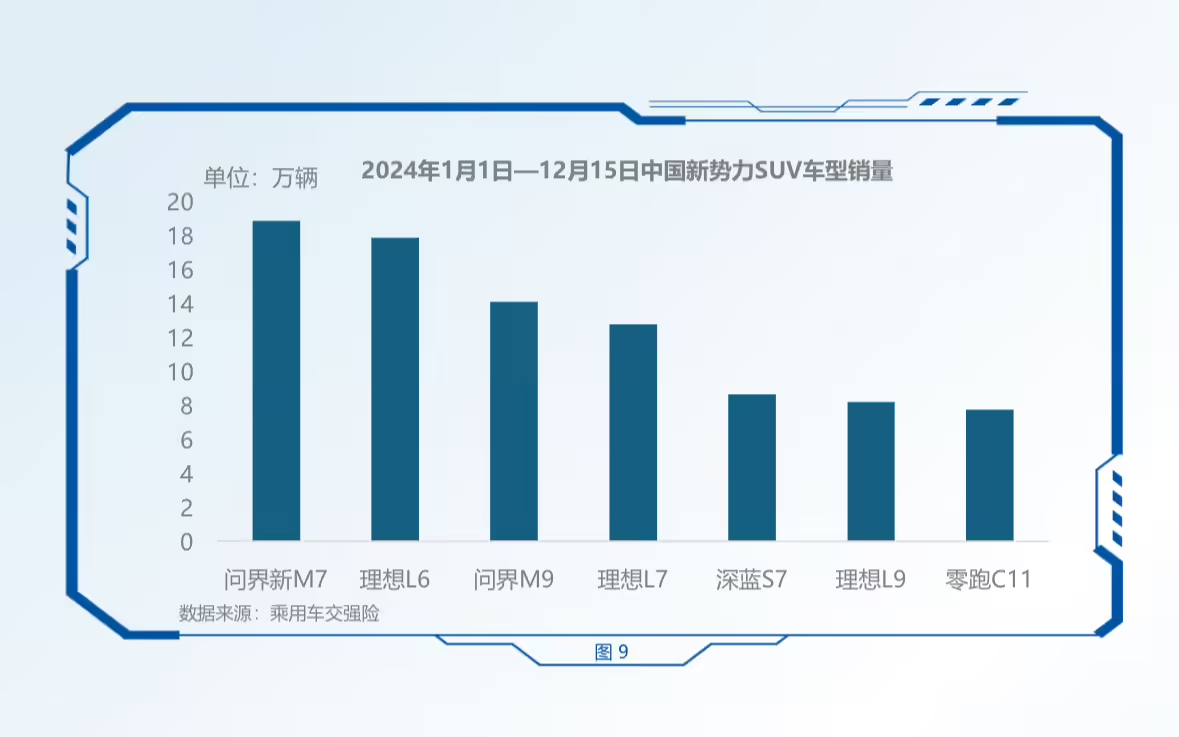

Chen Shihua, Deputy Secretary-General of the China Association of Automobile Manufacturers, said that thanks to the national policy of trading in old cars for new ones and the replacement and renewal policies introduced by local governments, the terminal sales of cars have improved. Among them, some new force companies and the new energy vehicle market have exceeded expectations, and the new quality productive forces in the automotive industry are rapidly transforming from quantitative to qualitative changes.

On the other hand, as time enters October, although the car market has entered the sales season, the problems faced by car dealers, such as the pressure of unsold model inventory, the inability to purchase popular models due to capital chain ruptures, and unreasonable inventory structure, still exist.

According to the "China Auto Dealer Inventory Warning Index Survey" (VIA) released by the China Automobile Dealers Association, the domestic auto dealer inventory warning index in October 2024 was 50.5%, a year-on-year decrease of 8.1 percentage points, and a month-on-month decrease of 3.5 percentage points, with the inventory warning index approaching the boom and bust line.

The data shows that among the above six dealer companies, three achieved year-on-year growth in net profit in the first three quarters.

In addition, in the 2024 China Auto Circulation Industry Dealer Group Top 100 list, Guanghui Auto has been delisted because the daily closing price has been below 1 yuan for 20 consecutive trading days.

In Zhang Xiuyang's view, the delisting of Guanghui Auto and the earlier delisting of Pangda Group are fundamentally due to the poor overall operating conditions of dealers in recent years.

Data from the China Automobile Dealers Association shows that under the continuous price war, the overall retail loss of China's new car market in the first eight months of this year was 138 billion yuan. According to the "2024 Half-Year National Auto Dealer Survival Status Survey Report," 50.8% of dealers were in a loss-making state in the first half of this year, basically the same as the 50.3% in the first half of 2023, with 35.4% of dealers making a profit, and nearly 14% of dealers in a break-even state.

"Manufacturers make money when selling cars, while dealers lose money. Since the main plant factory dominates the distribution of the entire interest chain, keeping the benefits for itself and transferring the losses to the dealers, it leads to the occurrence of phenomena such as forced sales and pressure warehouses from time to time, increasing the operating pressure on dealers and causing a large number of dealers to be in a loss or on the verge of loss," said Zhang Xiuyang.

Cui Dongshu, Secretary-General of the National Passenger Car Market Information Joint Conference, said that the overall net profit margin of China's auto dealers has dropped from 3% in 2018 to 2% in 2022, and to 0.7% in 2024. "The next step is to hope that relevant departments will organize a special survey on the financial environment of the auto distribution field, sort out the financial needs of the top 100 auto dealer groups, regional leading dealer groups, and small and medium-sized auto dealers, and study and formulate financing support policies for the automotive distribution industry as soon as possible."