The European Union confirmed a temporary increase in tariffs on Chinese electric vehicles from 17.4% to 37.6% starting from July 4th. Whether this will become a 5-year official tariff will be announced later by the European Commission. Before making the final decision, on July 16th, the EU held a "consultation vote" on the additional tariff measures for Chinese electric vehicles, and the results may have been somewhat unexpected for the European Commission: out of 27 EU member states, only 12 supported, 4 opposed, and countries like Germany, Finland, and Sweden, along with 11 others, abstained from voting.

Unfortunately, this vote is not binding, but the results will be taken into account by the European Commission. The abstention from so many countries also reveals a serious divergence of views within Europe on the additional tariffs, as they are aware of the risk of a trade war with China.

In another three months, the European Commission will make a formal decision on whether to levy official tariffs on Chinese-made electric vehicles. There is still room for negotiation and consultation, which also leaves some leeway for China.

But I would like to say that even if you impose tariffs, it cannot stop Chinese car companies from capturing the European market share.

BYD still has a positive profit even with a 17% tariff and remains competitive.

According to a report from consulting firm AlixPartners, in the short term, the imposition of tariffs will have a certain impact on the overseas expansion of Chinese new energy vehicle companies, but it will not stop the penetration rate of Chinese new energy vehicles in Europe. By 2030, the market share of Chinese new energy vehicles in Europe is expected to rise from 6% this year to 12%, of course, it will be lower than the expected 15% at the end of last year.

The report also mentioned that the cost advantage of Chinese new energy vehicles compared to European brands can be as high as 35%, and there is still room for price reduction to offset some of the impact of tariffs.

If we break down the cost advantage of Chinese new energy vehicles, it mainly relies on technology and high integration to reduce costs. Specifically, the highest 35% comes from low labor costs, and 75% comes from the value of the car, where 40% is the cost of the battery and 35% is the value of technology.

For example, BYD Seal, even with an additional 17.4% tariff, can still be on par with European car companies in terms of price and achieve a positive profit margin.

On the contrary, after the imposition of tariffs, German car companies such as BMW are the ones that suffer.

Rhodium Group also calculated the impact of the EU's tariff increase on the profitability of car companies. It also came to a similar conclusion that even with a 30% import tariff, models such as BYD Seal U and Atto 3 still have considerable profit margins.

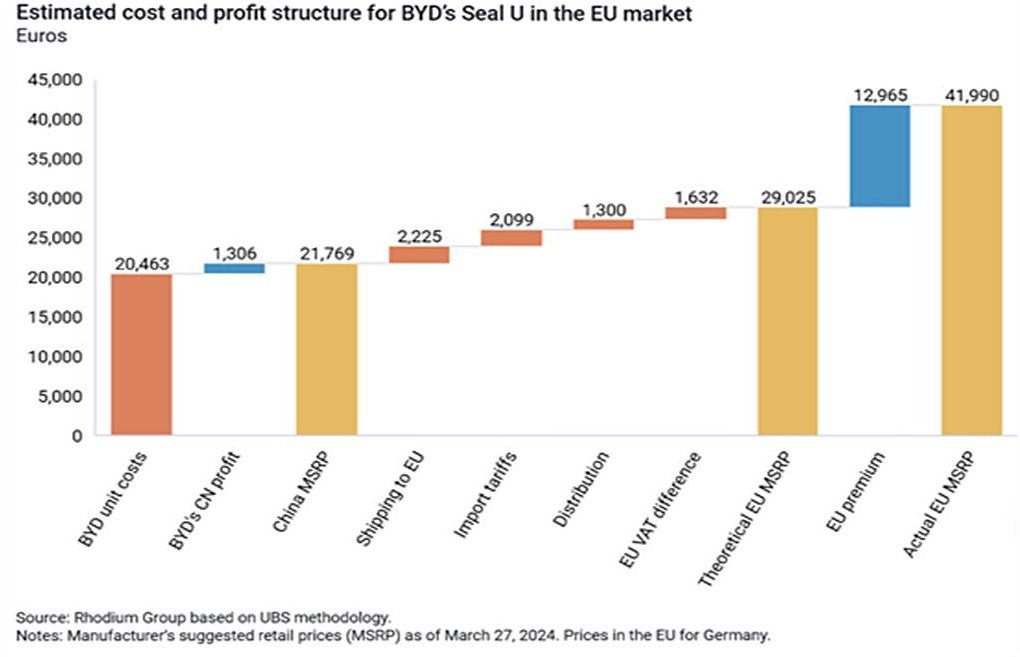

The following is the price/cost breakdown of BYD Seal U, all in euros. The production cost of a BYD Seal U in China is 20,463 euros, priced at 21,769 euros in China (about 170,000 RMB), with a profit of 1,306 euros (profit margin of 6%). After entering Europe, with additional costs such as transportation, customs clearance, and distribution, the total cost reaches 29,025 euros. With a pricing of 41,990 euros, the profit is 12,965 euros (a profit margin of 44.66%).

Even with a 30% tariff, BYD Seal U still has a profit margin of nearly 15%, which is still much higher than in the Chinese market.

For other Chinese new energy models, such as MG and Zeekr, after deducting a 30% tariff, the profit margin is still considerable, and the profit margin of MG4 can even exceed 10%. For smaller new forces such as NIO and XPeng, which rely on production in China and then transportation into the EU, the impact is greater.

A mere 17.4% to 37.6% tariff cannot suppress the pace of Chinese car companies entering the European market, but for foreign brands produced in China such as BMW and Tesla, it is a fatal blow. The profit of BMW iX3 in Europe is only 9% higher than in China, and as long as the tariff is higher than 9%, it will destroy the current business model of BMW.

There are always more ways than difficulties, Norway has always opposed tariffs, or will it become a European second-hand car transit country?

In 2023, 14.4% of new energy vehicles sold in Norway came from China. As early as May, when a reporter asked Norwegian Foreign Minister Espen Barth Eide whether he should ban Chinese electric cars, he firmly stated: "We should not ban Chinese electric cars, especially in a country like Norway, because we do not produce cars ourselves."

If the EU officially confirms a long-term increase in the import tariff on Chinese electric vehicles up to 48%, and on the other hand, Norway implements a 0% tariff, how do you think Chinese car companies might take advantage of this "loophole"?

An article from the Center for European and Chinese Studies at Fudan University believes that some Chinese car companies may register new cars in Norway and then export them as second-hand cars to other EU countries to avoid high tariffs. Norway could transform into a "free port" and transit center for European cars.

For now, second-hand cars imported from Norway to Germany only need to pay a 10% tariff. Changes may occur in the future, as the EU will not ignore this way of evading tariffs. However, how to regulate it specifically still needs to be observed.

For example, over the past year, a large number of Chinese cars have entered Russia through countries such as Kyrgyzstan, Kazakhstan, and Belarus to save on customs clearance costs. Since February of this year, the Russian government has discovered this "parallel import" problem and introduced policies requiring car companies and dealers to make up for the relevant costs.

The EU is not unaware - we are afraid that anti-subsidy is just the "appetizer"

Chinese car brands like BYD have a long-term goal of occupying the European market share, even at the cost of short-term losses, let alone there is still a lot of profit space to adjust prices in response to tariffs. German economists also believe that anti-subsidy tariffs cannot stop Chinese car companies from entering the European market to grab shares.

The European Commission will not be blind to this point. What we need to worry about is that anti-subsidy tariffs are just the appetizer, and later the EU or Western countries may have more means to deal with the expansion of Chinese car companies.

Conclusion and Outlook

Chinese car companies are currently in the ice-breaking period before localization, and frequent trade friction is a normal phenomenon. In the 1980s, Japanese cars entered the second stage of overseas expansion: localization deployment, and encountered the same trade restrictions in the European and American markets.

For Chinese car companies, can we learn and draw on the way the Japanese car industry went overseas in groups: domestically, under the assistance of the government, to complete the integration and form a chamber of commerce with [Toyota + Nissan + Honda] as the core of 7 car companies to go overseas together.

At present, Chinese car companies are basically fighting on their own, copying the successful domestic tactics to abroad, without seeing the situation of huddle together for warmth and jointly fighting the world. Because going overseas also requires the supply chain to go overseas, and scale effect is the focus of supply chain companies. Each car company wants to take its own supply chain overseas, without synergy and cooperation effect, which in the long run reduces efficiency.

It took more than 50 years for Japan's car globalization to be completed. We must adhere to long-termism, have more comprehensive considerations and top-level design to jointly deal with possible changes in the future.